- Bull Street

- Posts

- 📈 Salesforce’s AI-Powered Rally

📈 Salesforce’s AI-Powered Rally

BlackRock buys HPS for $12B, Okta shares pop 18%, PublicSqaure shares soar 270%, ServiceTitan seeks $5.2B valuation for IPO, Salesforce shares rise on earnings

Good morning.

⚡ The Fast Five → BlackRock buys HPS for $12B, Okta shares pop 18%, PublicSqaure shares soar 270%, ServiceTitan seeks $5.2B valuation for IPO, Salesforce shares rise on earnings

🔎 Market Trends → Nasdaq, S&P post record closing highs as tech extends gains; Futures tick up with focus on Fed commentary, economic data

And now…

⏱️ Your 5-minute briefing for Wednesday, December 4, 2024:

MARKET BRIEF

Before the Open

As of market close 12/3/2024.

Pre-Market

|

|

Fear & Greed

Markets in Review

Tech Leads the Charge While Dow Takes a Breather

The Nasdaq rose 0.4% to close at a record 19,480.9, while the S&P 500 edged up 0.1% to a record 6,049.9. The Dow Jones Industrial Average slipped 0.2% to 44,705.5, reflecting weakness in industrials.

The Big Picture:

Investors are savoring gains as the Nasdaq and S&P 500 notch fresh records, buoyed by strong technology and communication services performance. Despite a slight dip in the Dow, optimism persists as job openings surged to 7.74 million, signaling resilience in the labor market.

Meanwhile, oil prices jumped 2.7%, settling at $69.91 per barrel, reflecting expectations of tighter supply heading into 2024. Gold and silver also advanced, with gold up 0.3% to $2,665.70 per ounce and silver surging 2.1% to $31.51.

As the Federal Reserve leans dovish, the probability of a rate cut at the December meeting rose to 70%, sparking enthusiasm among growth-focused investors.

Market Movers:

Palantir (PLTR): Soared 6.9% after receiving FedRAMP 'high authorization', opening doors to lucrative government contracts.

AT&T (T): Gained 4.6% following its bold shareholder return strategy and plans to expand its fiber network.

Microchip Technology (MCHP): Dropped 7% after projecting lower-than-expected revenue, underscoring chip sector challenges.

Intel (INTC): Fell 6.1% amid leadership uncertainty, as reports surfaced of external candidates vying for the CEO role.

What They’re Saying:

“The labor market remains robust but is clearly moderating—a sweet spot for the Fed to step back and let markets breathe,” noted an analyst at Oxford Economics.

WHAT WE’RE WATCHING

Events

Today: ADP Non-Farm Employment Change - 8:15am

Why You Should Care: Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

Today: Fed Chair Powell Speaks at NYT DealBook Summit - 1:45pm

Why You Should Care: As head of the central bank, which controls short term interest rates, he has more influence over the nation's currency value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

Earnings Reports

Today: Royal Bank of Canada, Synopsis, Hormel, Campbells, Chewy, Dollar Tree

Tomorrow: Lululemon, Ulta, Dollar General, Docusign, HP

MARKET BRIEF

Leading News

Salesforce shares rise after earnings beat on revenue

Why it matters:

Salesforce (CRM) posted a 9% jump in share price after smashing fiscal Q3 earnings estimates and raising its FY25 revenue guidance.

Zoom Out:

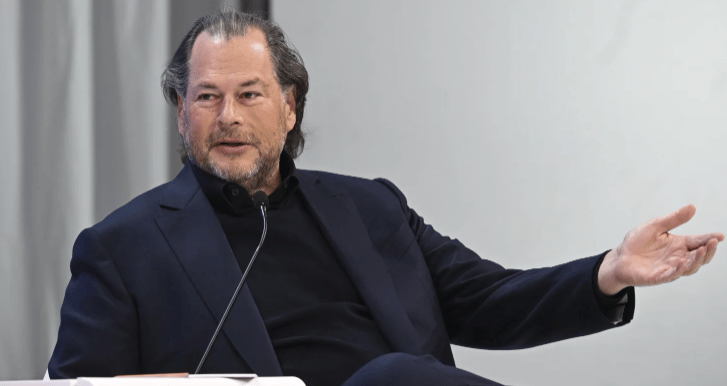

Salesforce’s Q3 performance wasn’t just about the numbers; it marked a defining moment for AI integration in enterprise software. CEO Marc Benioff spotlighted Agentforce, their AI-powered assistant, as the centerpiece of their growth strategy.

With 8% year-over-year revenue growth ($9.44B) and a 25% surge in net income, Salesforce showed it can navigate a challenging macro environment while laying the groundwork for future profitability. The AI narrative is capturing investor attention, particularly as enterprises look to adopt tools that boost efficiency and redefine customer engagement.

However, Salesforce still faces competition from giants like Microsoft (MSFT) and emerging AI startups. Investors are keenly watching its ability to sustain momentum in a crowded landscape.

Deep Dive:

Numbers to know:

Revenue: $9.44B (vs. $9.34B expected).

Q4 guidance: $9.9B–$10.1B, with midpoints above analysts’ estimates.

FY25 revenue raised slightly to $37.8B–$38B, signaling cautious optimism.

AI revolution: Agentforce is at the heart of Salesforce’s strategy, integrating AI agents into its ecosystem to drive productivity. Benioff called it a "bold leap into the future of work."

Investor dynamics: Activist investor Starboard Value boosted its stake by 40%, praising Salesforce’s improving margins and cost discipline.

Market Pulse:

“We’re delivering exceptional performance across revenue, margin, cash flow, and AI,” said Marc Benioff. "Agentforce is transforming customer interactions and elevating enterprise productivity."

Bull’s Take:

Salesforce is leveraging AI to cement its competitive edge, translating tech buzz into bottom-line growth. With strong guidance and increasing investor confidence, CRM is positioned to capitalize on the digital transformation wave.

Headlines

BlackRock seals $12bn deal to buy HPS Investment Partners (link)

Palantir Price Levels to Watch as Stock Jumps to New All-Time High (link)

Okta shares pop 18% on earnings beat, strong guidance (link)

Donald Trump Jr. joins e-commerce company PublicSquare as its shares soar 270% (link)

Software startup ServiceTitan seeks up to $5.2 billion valuation in US IPO (link)

CRYPTO

Fear & Greed

Headlines

DAILY SHARE

On the Socials

*Hat-tip to netcapgirl

Why This Gold Stock is Our Top Trade of the Month

Tiny Float: Just 19 million shares outstanding with strong insider ownership.

Stock Performance: Up 200% in recent years and primed for the next breakout.

Ideal Timing: Upcoming catalysts + gold pullback = prime opportunity.