- Bull Street

- Posts

- 📈 OpenAI's Profit Makeover

📈 OpenAI's Profit Makeover

Semiconductor Supercycle launch, Meta’s new smart glasses, US Steel Nippon merger green light again, Lower standards at Boeing, OpenAI & Altman’s big payday

Good morning.

⚡ The Fast Five → Semiconductor Supercycle launch, Meta’s new smart glasses, US Steel Nippon merger green light again, Lower standards at Boeing, OpenAI & Altman’s big payday

And now…

⏱️ Your 5-minute briefing for Thursday, September 26, 2024:

MARKET BRIEF

Before the Open

As of market close 9/25/2024.

Pre-Market

|

|

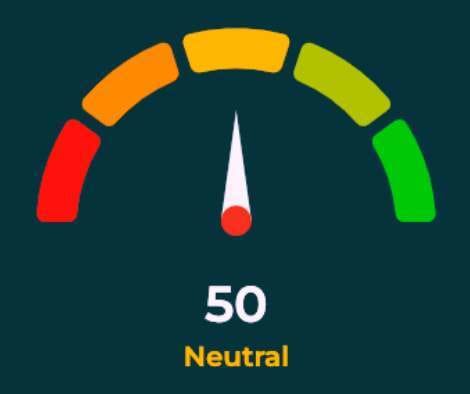

Fear & Greed

*UP 2 pts

Trends

S&P 500, Dow close lower as investors await insights on Fed rates, data

Fed's bumper rate cut revives 'reflation specter' in US bond market

Nasdaq 100 Futures Gain as Chip Stocks Jump

WHAT WE’RE WATCHING

Events

Today: Final Gross Domestic Product, 8:30AM

Why You Should Care: It's the broadest measure of economic activity and the primary gauge of the economy's health

Earnings Reports

Today: Costco, Accenture, Jabil, CarMax, Scholastic

Tomorrow: NeoVolta, HHG Capital, SPI Energy, Santech

MARKET BRIEF

Leading News

OpenAI's Game-Changing Move: Altman's Big Payday and What It Means for Tech Investors

Why it matters: This move could reshape the AI landscape and create massive investment opportunities in the tech sector.

The big picture: OpenAI, the AI powerhouse behind ChatGPT, is eyeing a major transformation. They're talking about:

Giving CEO Sam Altman a whopping 7% stake

Switching to a for-profit model

Potentially becoming a public benefit corporation

This comes as OpenAI's valuation skyrockets to $150 billion and they seek to raise another $6.5 billion.

Go deeper:

Follow the money: Altman's potential stake could be worth over $10 billion. That's some serious skin in the game!

Tech talent shuffle: CTO Mira Murati is out, signaling more shakeups in OpenAI's C-suite. Keep your eyes peeled for how this impacts innovation.

AI arms race heats up: This move could give OpenAI more firepower to compete with tech giants like Google (GOOGL) and Microsoft (MSFT).

What they're saying: OpenAI spokesperson: "The nonprofit is core to our mission and will continue to exist." But let's be real – this shift screams ‘we're here to dominate the AI market!’

The bottom line: OpenAI is gearing up for hypergrowth. This could be your ticket to ride the AI revolution. But remember, with great potential comes great volatility – so buckle up and do your DD!

Chip Stocks Blast Off as Micron Forecast Ignites Semiconductor Supercycle

Why it matters: The semiconductor industry is flexing its muscles, signaling a potential boom that could supercharge your tech portfolio.

The big picture: Chip stocks are on fire! Micron Technology (MU) just dropped a bombshell earnings forecast that's sending shockwaves through the industry. We're talking a major shift in the semiconductor landscape, with players like TSMC (TSM) and ASML (ASML) riding the wave to new heights.

This isn't just a flash in the pan – we're witnessing the birth of a new semiconductor supercycle. The AI revolution is hungry for chips, and these companies are stepping up to the plate.

Go deeper:

Memory chip bonanza: Micron's bullish outlook suggests a major turnaround in the memory market. DRAM and NAND flash prices could skyrocket, fattening profit margins.

AI appetite grows: The insatiable demand for AI chips is spilling over into adjacent markets. Expect a ripple effect across the entire semiconductor ecosystem.

Global players surge: Asian chip giants are joining the party. Keep your eyes on Samsung (005930.KS) and SK Hynix (000660.KS) as they ramp up production to meet demand.

What they're saying: "We believe we are at the start of a multi-year growth phase for our industry," - Micron CEO Sanjay Mehrotra

The bottom line: The chip sector is white-hot, and investors should consider riding this wave. But remember, semis are cyclical – so stay nimble and watch for signs of oversupply.

Headlines

Arbitration board gives green light to US Steel-Nippon Steel merger over union's objections (link)

Boeing staff report pressure to lower standards (link)

What's Going On With Walt Disney Stock (link)

What products would be disrupted by a port strike? (link)

X releases its first transparency report since Elon Musk's takeover (link)

"Sounds Like Corruption": FCC Fast-Tracks "Soros Shortcut" Purchase Of 200+ Radio Stations (link)

Meta’s Ray-Ban branded smart glasses are getting AI-powered reminders and translation features (link)

Inside the Fertility Tech Gold Rush (link)

CRYPTO

Fear & Greed

*DOWN 9 pts

Headlines

DAILY SHARE

On the Socials

*Hat-tip to netcapgirl