- Bull Street

- Posts

- 📈 Market reacts to shooting

📈 Market reacts to shooting

Trump shooting changes Biden’s strategy, how traders are expected to react, Trump victory trades to swell, Jamie Dimon warns interest rates may stay higher, and Elon Musk endorses Trump…

Good morning.

The Fast Five → Trump shooting changes Biden’s strategy, how traders are expected to react, Trump victory trades to swell, Jamie Dimon warns interest rates may stay higher, and Elon Musk endorses Trump…

Calendar: (all times ET)

Today: Fed Chair Powell speaks, 12 PM

TUE, 7/16: US retail sales, 8:30 AM

WED, 7/17: Fed Beige Book, 2:00 PM

THU, 7/18: Initial jobless claims, 8:30 AM

Your 5-minute briefing for Monday, July 15:

BEFORE THE OPEN

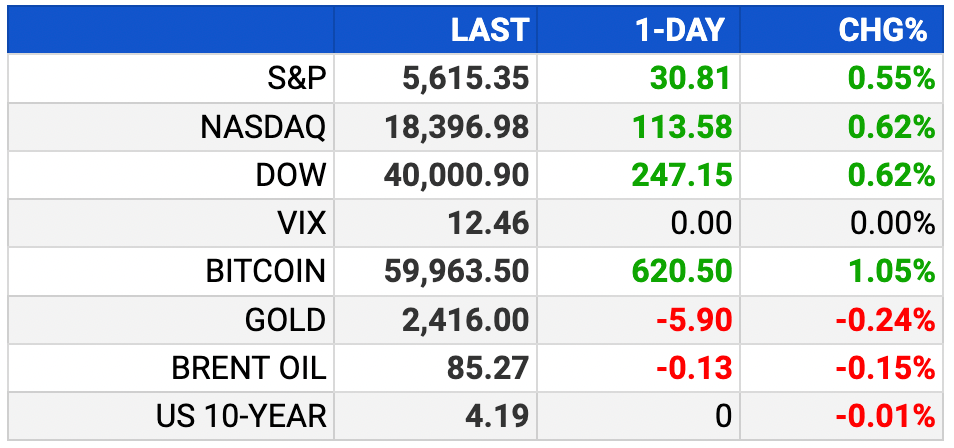

As of market close 7/12/2024. Bitcoin as of 7/14/2024.

PRE-MARKET

MARKETS

US stocks rose on Friday on growing optimism for Fed rate cuts

Russell 2000 had its best week since November

Dow closed at an ATH

Europe's Stoxx 600 had its best week in two months

Yen hit a four-week high versus the dollar

EARNINGS

JPMorgan beat Q2 estimates on record profit and revenues driven by a 52% surge in IB fees and 10% jump in trading revenue (link)

Citigroup topped Q2 earnings and revenue estimates on a 37% rise in equities trading revenue and 60% rise in IB revenue (link)

Wells Fargo shares fell ~6% despite beating Q2 analyst estimates as a 9% drop in net interest income offset a 38% surge in IB revenue (link)

What we're watching this week:

Today: Goldman Sachs, BlackRock

Tuesday: Bank of America, Morgan Stanley, UnitedHealth Group

Wednesday: ASML, United Airlines, Johnson & Johnson

Thursday: TSMC, Netflix, Domino's

Friday: American Express

Full calendar here

NEWS BRIEFING

Conversation dominated by assassination attempt, not Biden. Politicians call to tone down rhetoric in midst of campaign.

Saturday’s shooting at former President Trump’s election rally raises his odds of winning back the White House, and trades betting on his victory will increase this coming week, investors said on Sunday.

How traders are expected to react to Trump rally shooting (link)

US futures steady as traders digest latest geopolitical shock (link)

Global markets ramp up the ‘Trump trade’ after rally attack (link)

US producer price data points to subsiding inflation pressures (link)

Oil steadies with dollar strength in focus after Trump shooting (link)

Yen’s woes seem too big for even a BOJ hike to solve (link)

Elon Musk endorses Trump in presidential race, calls him "tough" (link)

Jamie Dimon warns inflation and interest rates may stay higher (link)

OpenAI whistleblowers ask SEC to investigate alleged restrictive non-disclosure agreements (link)

Amazon must comply with US agency's pregnancy bias probe (link)

South Korea's SK On in talks to supply prismatic EV batteries as it seeks turnaround (link)

Citigroup seeks to end racial-bias lawsuit over ATM fees (link)

CRYPTO

DAILY SHARES

When the Jefferies analyst who went to Baruch lands a job at a mega fund

— Karl Smith, CFA (Level 1 Candidate) (@wallstreetkarl)

8:03 PM • Jul 14, 2024

Keep the curation going! Buy the team a coffee ☕️