- Bull Street

- Posts

- 📈 Investors react to Biden exit

📈 Investors react to Biden exit

Investors react to Biden pulling out of race, markets could unwind the ‘Trump trade’ with Biden out, markets broaden as investors sell tech winners, a market rotation of historic proportions is taking shape, and who gets the $96M sitting in Biden’s campaign account?

Good morning.

The Fast Five → Investors react to Biden pulling out of race, markets could unwind the ‘Trump trade’ with Biden out, markets broaden as investors sell tech winners, a market rotation of historic proportions is taking shape, and who gets the $96M sitting in Biden’s campaign account?

Calendar: (all times ET)

WED, 7/24: New home sales, 10:00 AM

THU, 7/25: GDP, 8:30 AM

Initial jobless claims, 8:30 AM

Durable-goods orders, 8:30 AM

FRI, 7/26: PCE index, 8:30 AM

Consumer sentiment, 10:00 AM

Your 5-minute briefing for Monday, July 22:

BEFORE THE OPEN

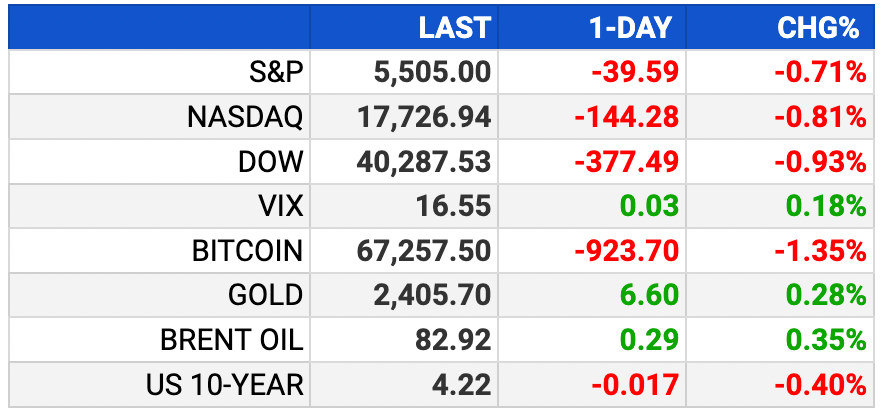

As of market close 7/19/2024. Bitcoin as of 7/21/2024.

PRE-MARKET

MARKETS

US stocks fell further on Friday as markets reacted to a global IT outage and prepared for Big Tech earnings this week

S&P and Nasdaq posted their biggest weekly losses since April

Nasdaq snapped a six-week win streak

Europe's Stoxx 600 lost 2% in its biggest weekly fall YTD

Bitcoin hit a one-month high

EARNINGS

American Express missed Q2 revenue estimates but beat on earnings and raised its FY profit forecast thanks to robust spending by wealthy customers (link)

What we're watching this week:

Tuesday: Tesla, Alphabet, Spotify, UPS, Visa

Wednesday: Chipotle, Ford, AT&T, IBM

Thursday: American Airlines

Full calendar here

NEWS BRIEFING

Biden ended his reelection campaign on Sunday after fellow Democrats lost faith in his mental acuity and ability to beat Trump, leaving the presidential race in uncharted territory.

Biden's exit from the presidential race on Sunday could prompt investors to unwind trades betting that a Republican victory would increase US fiscal and inflationary pressures.

Who gets the $96M sitting in Biden’s campaign account? (link)

Soros backs Harris as other Wall St democrats want a contest (link)

China social media embraces Trump after Harris steps into race (link)

Geopolitics overtakes inflation at top of sovereign wealth fund worry list (link)

Gold jumps to record as traders ramp up bets on Fed rate pivot (link)

Dollar eases as Biden ends re-election bid (link)

Gold climbs as election chaos escalates (link)

Markets broaden as investors sell tech winners (link)

Unpacking how Alphabet’s rumored Wiz acquisition could affect VC (link)

Tesla Sales Drop 17% in California (link)

WazirX halts trading after $230 million ‘force majeure’ loss (link)

US FAA probes latest Southwest Airlines flight that posed safety issues (link)

A stock market rotation of historic proportions is taking shape (link)

CRYPTO

Bitcoin surged to $67,656, its highest since June, despite JPMorgan analysts doubting the crypto market recovery (link)

Grayscale announced plans to spin off 10% of its Bitcoin Trust (GBTC) into a new ETF, the Grayscale Bitcoin Mini Trust (BTC) (link)

Arkham transferred $487 million worth of ARKM tokens to Coinbase Prime for tax compliance as linear token unlocking began (link)

Galaxy Digital acquired nearly all of CryptoManufaktur's assets, adding $1 billion in staked Ethereum to its portfolio (link)

DAILY SHARES

LinkedIn is out of control

— Chris Bakke (@ChrisJBakke)

7:52 PM • Jul 21, 2024

Keep the curation going! Buy the team a coffee ☕️