- Bull Street

- Posts

- 📈 Inflation cools

📈 Inflation cools

Inflation broadly cools paving way for rate cuts, see inflation breakdown in one chart, Biden confuses Kamala for Trump, Zelenskiy for Putin, Tesla shares drop after robotaxi unveiling delay, and some pics from Sun Valley's 'summer camp for billionaires'…

Good morning.

The Fast Five → Inflation broadly cools paving way for rate cuts, see inflation breakdown in one chart, Biden confuses Kamala for Trump, Zelenskiy for Putin, Tesla shares drop after robotaxi unveiling delay, and Apple lets rivals use tap-and-go payments as EU's Vestager warns on tech charges'…

Calendar: (all times ET)

Today: Producer price index (PPI), 8:30 AM

Consumer sentiment, 10:00 AM

Your 5-minute briefing for Friday, July 12:

A Message From Percent

Explore the Benefits of Private Credit Investing

Curious about expanding your portfolio beyond stocks and bonds? You might be interested in private credit, where you can lend money to corporate borrowers in exchange for an expected contractual return on your principal.

Why private credit? Allocating 10% of a portfolio to private credit instead of stocks and bonds alone has historically raised returns and lowered volatility1. As a result, private credit has become increasingly popular with institutional investors, like Blackstone, Morgan Stanley and KKR.

Percent simplifies access to private credit investing with low minimums (just $500) and shorter durations (typically 6-36 months) through their marketplace. Plus, deals are available to both institutional and individual accredited investors, making it one of the few places an everyday investor could get in.

Historical data on private credit returns remains strong: In 2023, private credit averaged a 12% return2 globally, and on Percent, a net return of 14.5%.

Visit Percent to learn more - plus get up to $500 with your first investment.

Disclaimer: Alternative investments are speculative and possess a high level of risk. No assurance can be given that investors will receive a return of their capital. Those investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and those investors who cannot hold an investment for an indefinite term should not invest. Private credit investments may be complex investments and they are subject to default risk.

BEFORE THE OPEN

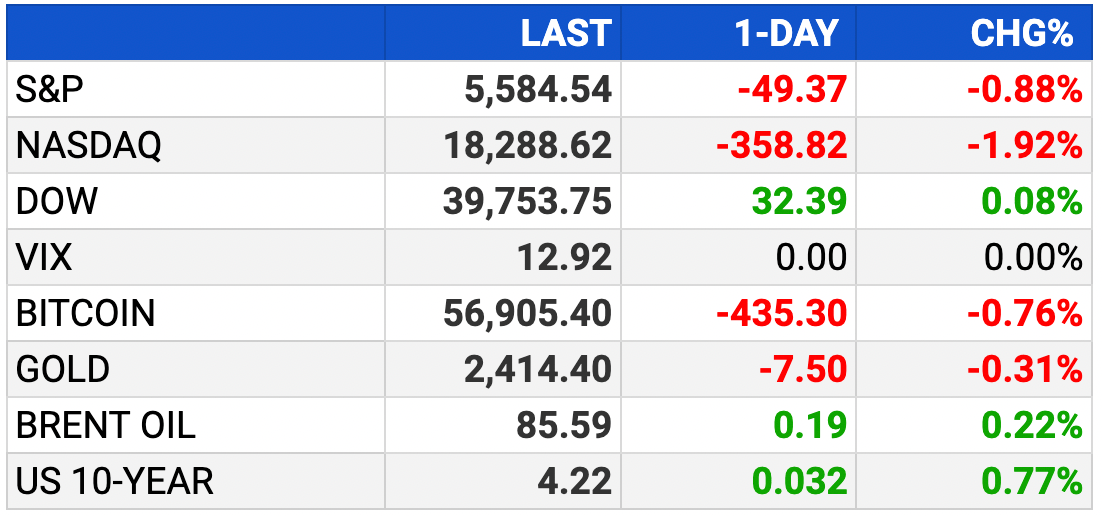

As of market close 7/11/2024.

PRE-MARKET

MARKETS

US stock indexes swayed dramatically as investors swapped growth for value after inflation data all but guaranteed a path for Fed rate cuts

Russell 2000 beat Nasdaq by the biggest one-day margin ever

Russell 2000 hit its highest since March 2022 in its best day since November

'Mag 7' stocks tumbled 4.5% in their sharpest drop since October 2022

S&P and Nasdaq broke seven-day win streaks in their worst day since April

Traders priced in a September rate cut and 40% chance of three by December

Europe's Stoxx 600 hit a one-month high, just inches away from its ATH

US 2Y to 10Y yields dropped to their lowest since mid-March

Pound surged to a one-year high versus the dollar

Yen surged 2.5% in its biggest jump since late-2022 on apparent BOJ intervention

Emerging market currencies jumped to their highest since May

EARNINGS

Delta missed Q2 revenue estimates and projected below-estimate Q3 sales as flight guts weigh on otherwise booming summer demand (link)

PepsiCo beat Q2 EPS estimates but missed on revenue and gave a cautious FY outlook on weakened US consumer demand (link)

What we're watching this week:

Today: JPMorgan, Wells Fargo, Citigroup

Full calendar here

NEWS BRIEFING

A series of high-profile gaffes during the NATO summit on Thursday renewed concerns about Biden's age and acuity threatening his presidential campaign.

Traders all but fully price in September and December interest-rate cuts.

Here’s the inflation breakdown for June 2024 - in one chart (link)

Nasdaq sharply lower as investors rotate out of Big Tech (link)

Stock rotation hits megacaps on bets Fed will cut (link)

Emerging-market currencies highest since May on CPI data (link)

US June budget deficit shrinks to $66B after calendar shifts (link)

Oil rises for third day on improving demand and weaker dollar (link)

Tesla shares down 8% after report of robotaxi unveiling delay (link)

Apple lets rivals use tap-and-go payments as EU's Vestager warns on tech charges (link)

Boeing nearing deal to sell 777X jets to Korean Air (link)

Bain Capital to buy financial software vendor Envestnet in $4.5 bln deal (link)

Pfizer stock rises as company advances studies of once-a-day weight-loss pill (link)

Louisville-based GE Appliances to layoff 4% of global salaried workforce (link)

CRYPTO

40% of Ethereum's supply is locked up as the market braces for potential spot ETH ETF approvals (link)

The SEC quietly dropped its investigation into Paxos and the BUSD stablecoin (link)

Goldman Sachs plans to launch three tokenization projects by year-end amid renewed client interest in crypto (link)

DAILY SHARES

“why is the market down after a cool CPI print?”

— sophie (@netcapgirl)

3:03 PM • Jul 11, 2024

Keep the curation going! Buy the team a coffee ☕️