- Bull Street

- Posts

- 📈 FAA freezes 737's

📈 FAA freezes 737's

China weighs stock market rescue package, S&P 500 notches third straight record high close, Netflix pays $5 Billion for WWE’s ‘Raw’, unemployment rises in nearly a third of US states, and Red Sea turmoil sends economic shockwaves far and wide…

☕️ Good morning.

The Fast Five → Microsoft hits $3 Trillion value, Trump races toward 2024 Biden rematch after New Hampshire win, FAA limits Boeing 737 production, SEC approves tougher rues for SPAC’s, and Exxon shareholder lawsuit marks end of ESG era…

Your 5-minute briefing for Thursday, January 25:

BEFORE THE OPEN

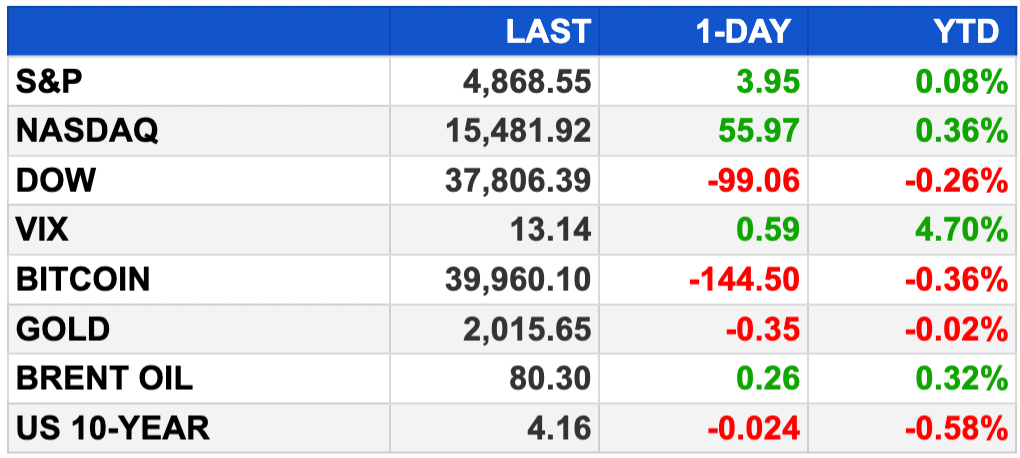

As of market close 1/24/2024.

PRE-MARKET

MARKETS

US stocks closed mixed as technology stocks rallied

The Nasdaq rose 0.36%, while the Dow fell 0.26%

Asian stocks mostly rose, led by a jump in Chinese stocks, as investor sentiment improves thanks to a possible Chinese stimulus package

European stocks rose, boosted by upbeat tech earnings

EARNINGS

Tesla missed Q4 earnings and revenue estimates as auto sales increased 1% YoY; the automaker warned of lower vehicle volume growth in 2024, its share price fell 5.7% AH (link)

ASML shares surged 9% to a record high after beating Q4 earnings expectations and reporting a growing order backlog that points to a recovery in the computer chip market (link)

AT&T beat Q4 revenue estimates but missed on adjusted earnings; the company’s 2024 earnings outlook also fell short of expectations (link)

IBM shares rose 7% after beating Q4 earnings and revenue estimates partly thanks to demand for its AI products and services as well as hybrid cloud (link)

What we're watching this week:

Today: Intel, Visa, Blackstone, American Airlines, Comcast, Next Era Energy

Friday: American Express

Full calendar here

NEWS BRIEFING

Software giant is second company to hit level, following Apple. AI services are seen as a long-term revenue growth tailwind.

The FAA said on Wednesday that it would not allow Boeing to expand 737 MAX production in the wake of a mid-air emergency on an Alaska Airlines jet.

Trump races toward 2024 Biden rematch after New Hampshire win (link)

SEC approves tougher rules for SPACs (link)

Exxon shareholder lawsuit marks end of ESG era (link)

S&P 500 ekes out another record high as Netflix and chipmakers leap (link)

Tesla projects slower growth in 2024 as EV demand softens (link)

Bank of Canada expected to hold rates steady in Wednesday policy decision (link)

Alphabet shares flirt with record high on AI hype (link)

The Middle East crisis is starting to weigh on the economy (link)

HPE hacked by same Russian intelligence group that hit Microsoft (link)

Slovakia says Ukraine open to Russian gas transit beyond 2024 (link)

IBM sees strong 2024 sales, free cash flows; job cuts planned (link)

Chipotle to offer new benefits to draw younger workers for burrito season (link)

Ships hauling US government cargo in Red Sea turn back after explosions nearby (link)

Tesla will start making new EV model in second half of 2025 (link)

Cornell donor demands President’s ouster over diversity policies (link)

Las Vegas Sands stock rises as Chinese gamblers defy economic worries (link)

NATO’s largest military exercise since Cold War kicks off (link)

Jim Harbaugh bolts from Michigan to coach the NFL’s Los Angeles Chargers (link)

CRYPTO

BULLISH BITES

🍎 Anniversary: The Mac turns 40 — and keeps on moving.

⛷ Over-the-top: 6 ski destinations that stretch the limits of luxury.

🙈 Holy scam: Cryptocurrency scams truly work in mysterious ways.

📍 Steal this: Navigate the GenAI era with this startup map.

FEATURED TRADES

Taking a fresh look at $XLE

The Energy Select Sector SPDR Fund (ticker: XLE) is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Energy Select Sector Index, which includes companies from the oil, gas, consumable fuels, energy equipment, and services industries.

Ticker: XLE | Price: $81.67 | Price Target: N/A

Market Cap: N/A | Timeframe: N/A

🛢️ Oil/Gas | 🔄 Turnaround | 📈 Bullish Idea

Read the full article here. Read time: 5 min

DAILY SHARES

Vanguard investors:

— Ben Carlson (@awealthofcs)

2:41 PM • Jan 24, 2024

What did you think about today's briefing? |

Keep the curation going! Buy the team a coffee ☕️